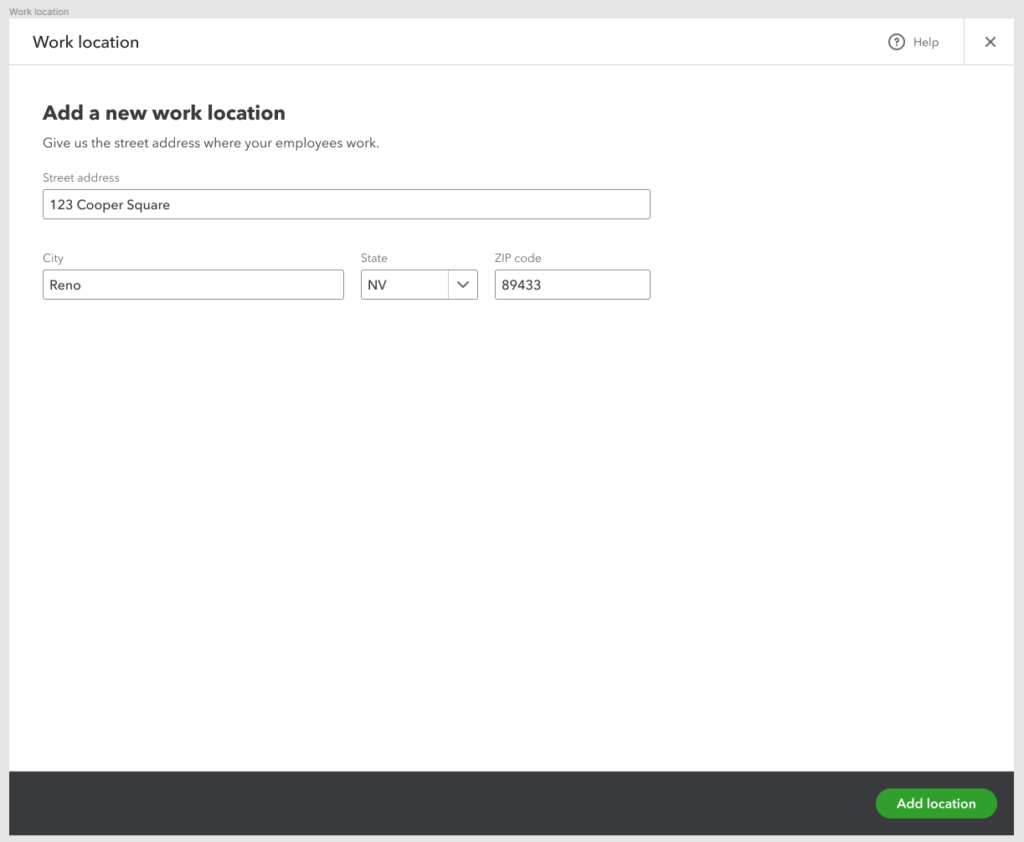

Work location

Creating content to guide customers through onboarding, reducing errors and support calls along the way.

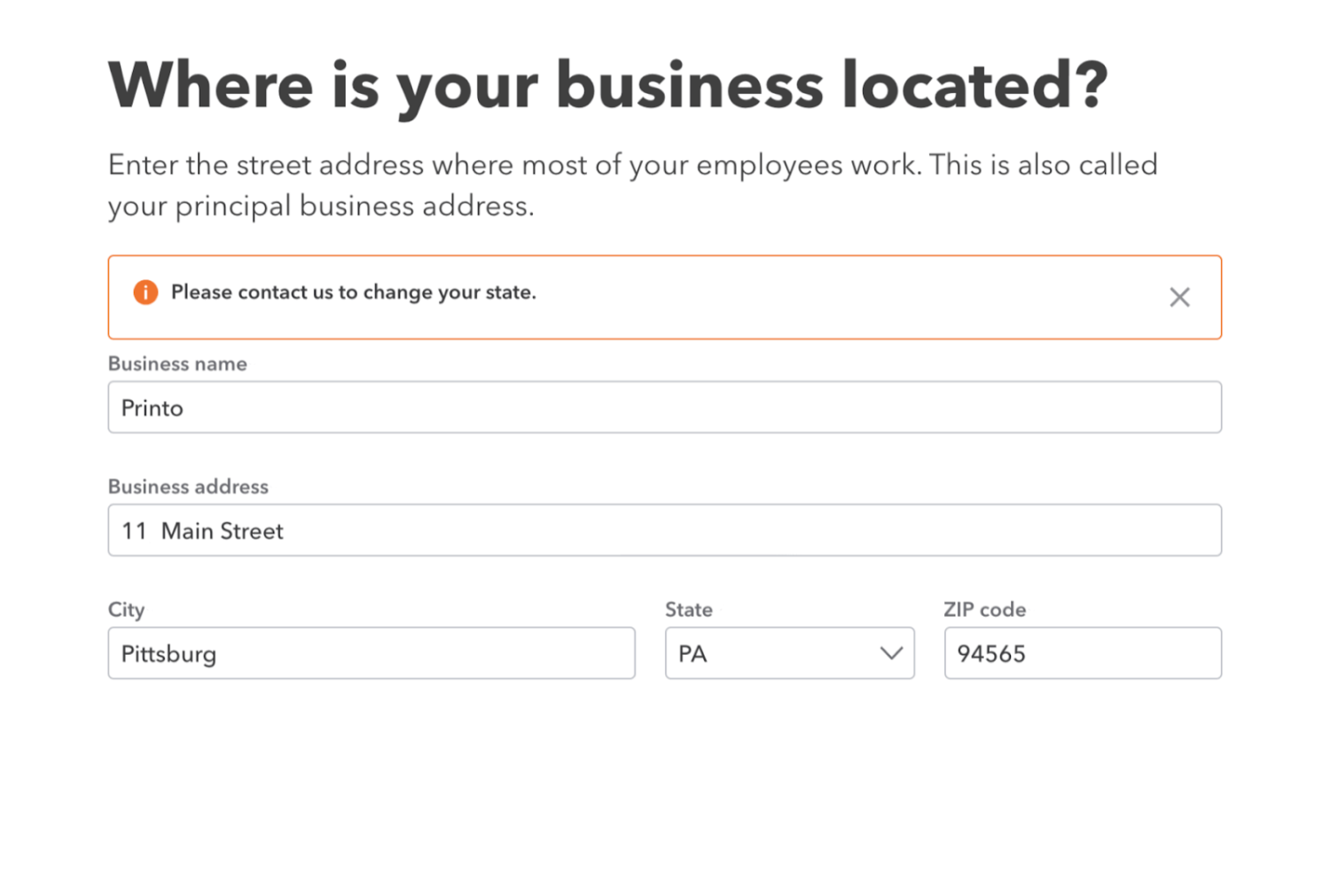

The problem

During payroll onboarding, customers couldn’t change their primary work location or add additional locations. This was especially frustrating for small business owners with employees in multiple locations or states. Without a way to do it themselves, they were often blocked early in setup, forced to call support, and left feeling frustrated, helpless, and unsure about the rest of the process. This missing functionality led to incorrect setups and a spike in support volume. During the 2019 peak season, 15% of setup-related calls were tied to this issue.

The solution

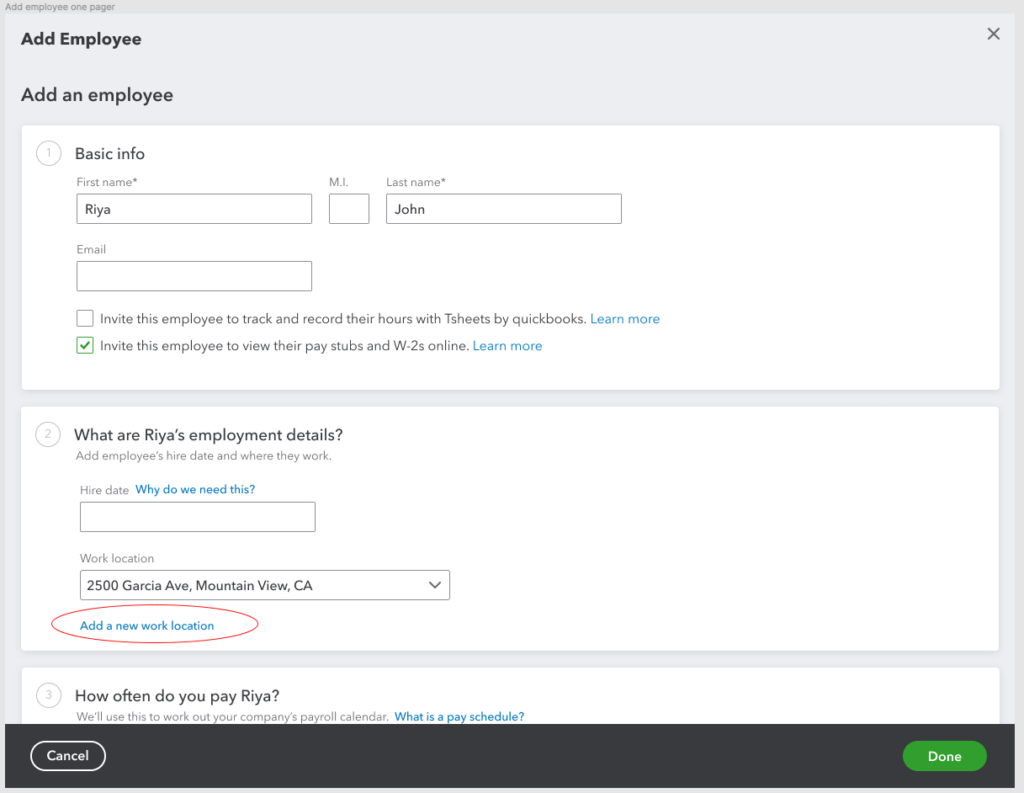

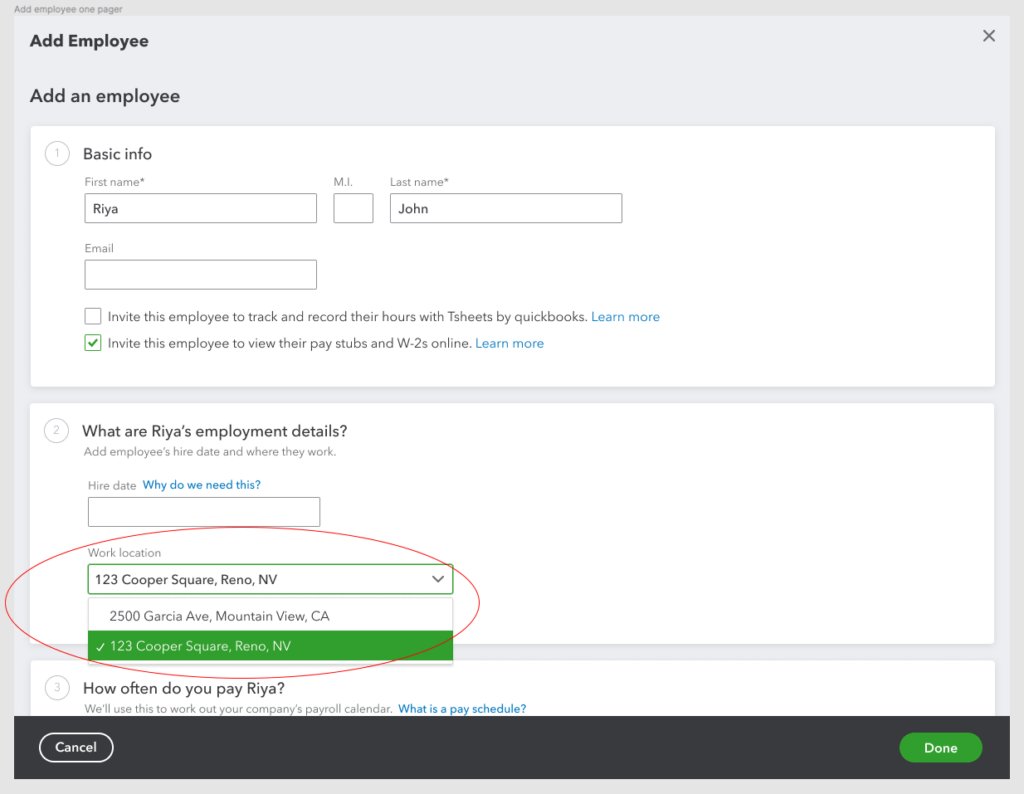

We made it possible for customers to easily add or change locations on their own without needing to contact support. The content design objective was to make the experience feel simple and stress-free, so customers could confidently update their locations.

My role

As the content designer on this project, I focused on creating clear and reassuring content that walked them through the process, step by step. I worked closely with my product design partner, as well as our product manager, engineering, and legal and compliance partners.

Original experience

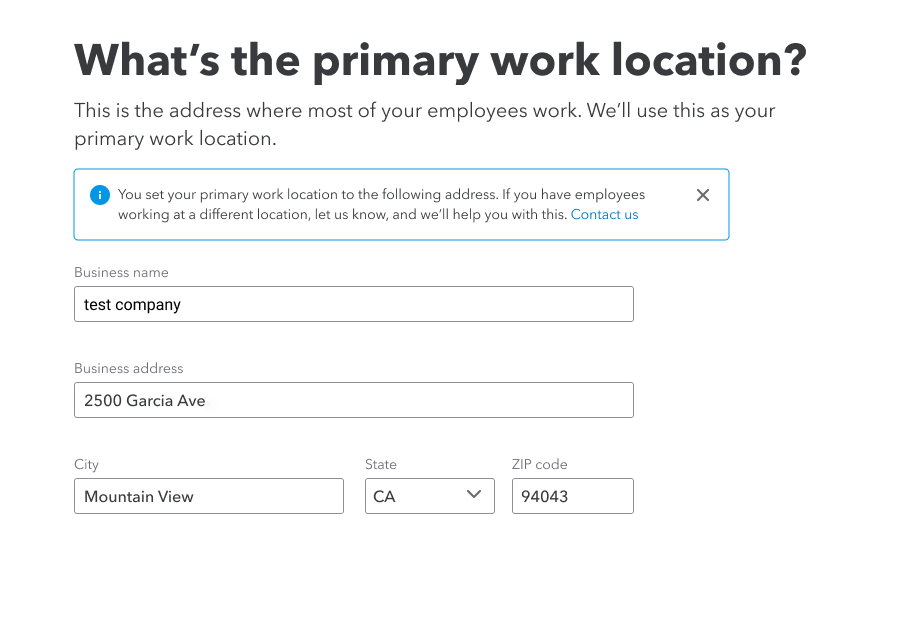

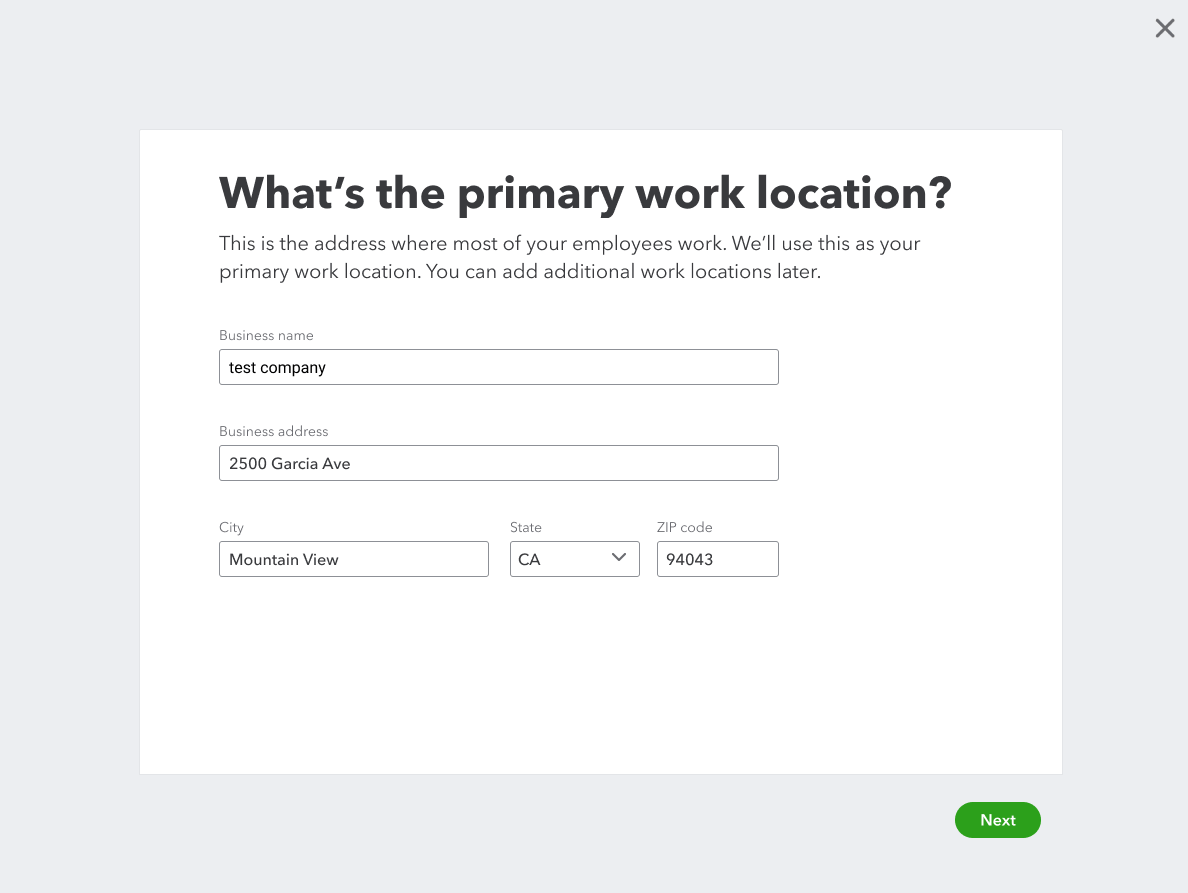

New experience: version 1

•We introduced the term “work location” since it’s less formal than “principal business address” and explains what we’re looking for. It’s also familiar wording used on IRS forms.

•A message confirms that a work location was set.

•We give guidance if they need to change something.

•“Contact us” opens a window where users can request a call back, chat with support, or search for community articles.

Version 2

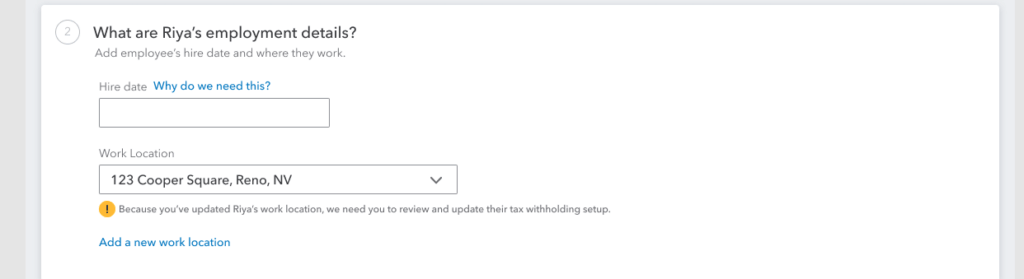

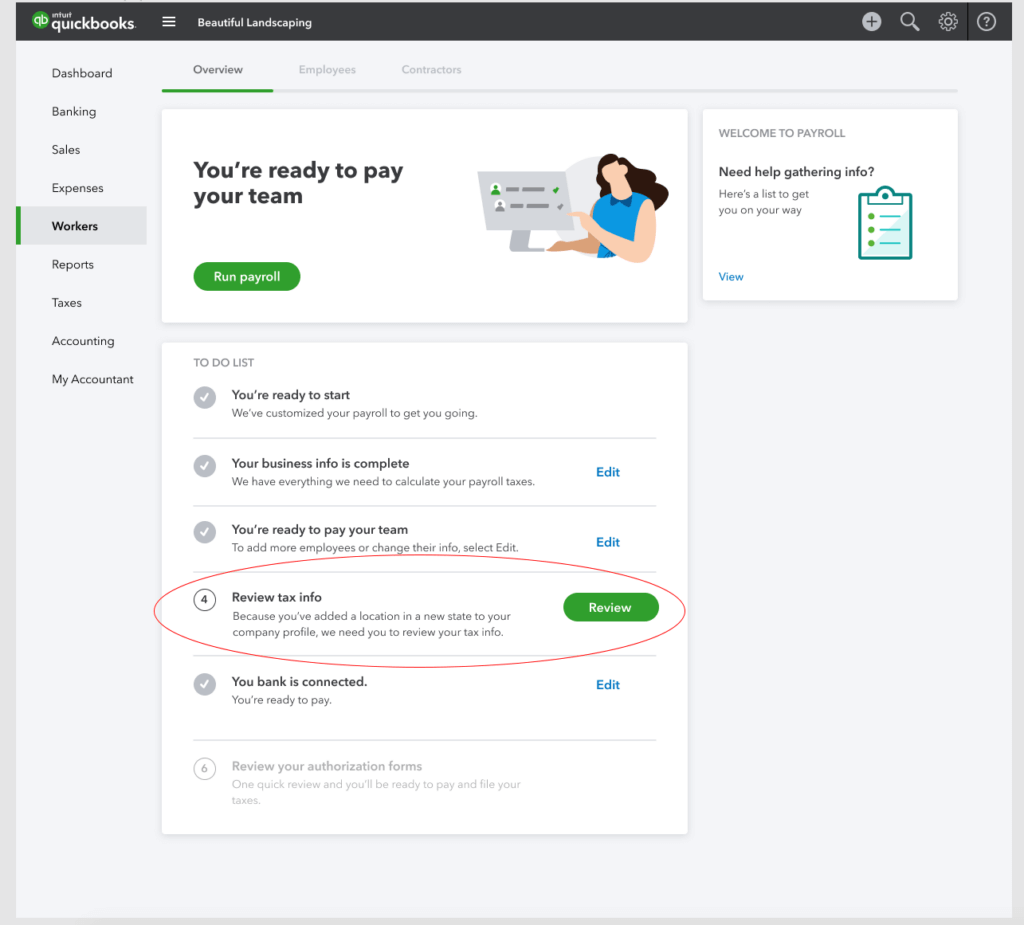

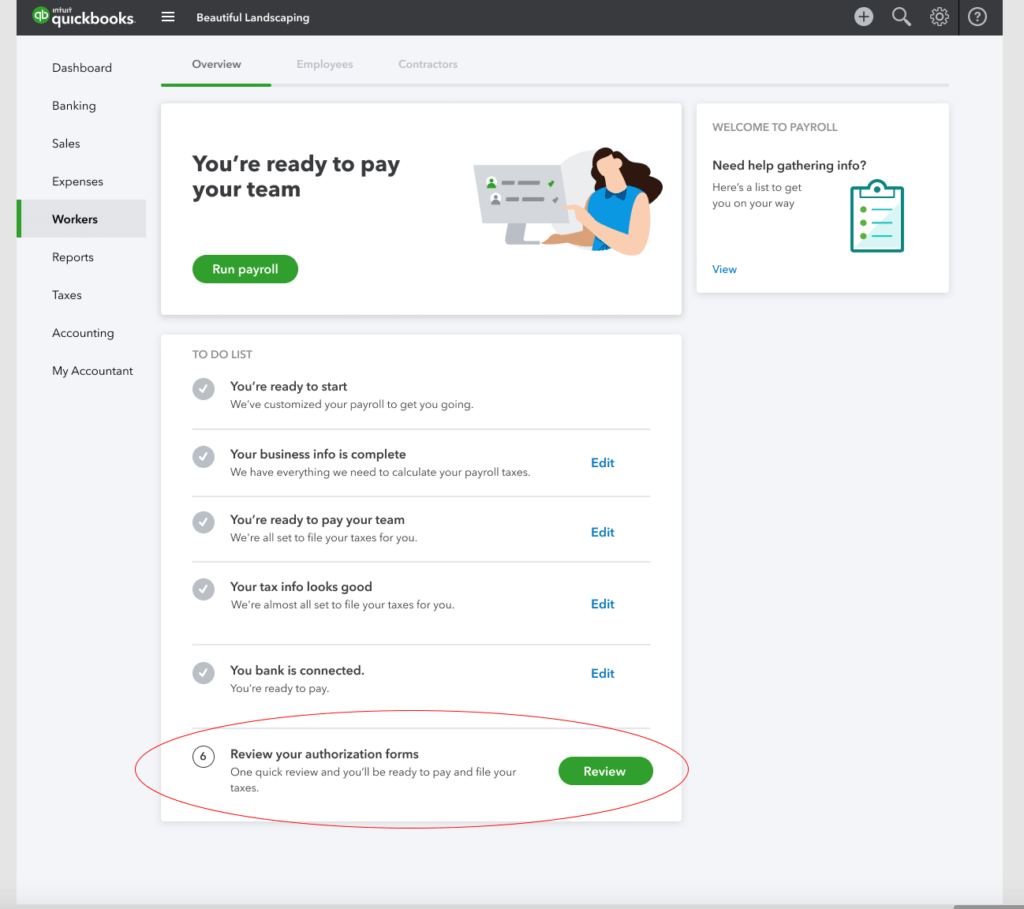

•I created a reminder for employers to review their tax info.

•Typically, once someone completes setup, the tasks have a CTA of “Edit.” But we wanted to draw attention to the fact that because they made a change, they need to look at their info again.

•Since we don’t know for a fact if they need to update or change, “review” was the best fit.

Just like with the tax forms, I added a reminder for employers to review their tax authorization forms because of changes they made to their work location.